In the driver’s seat: The financial state of customers.

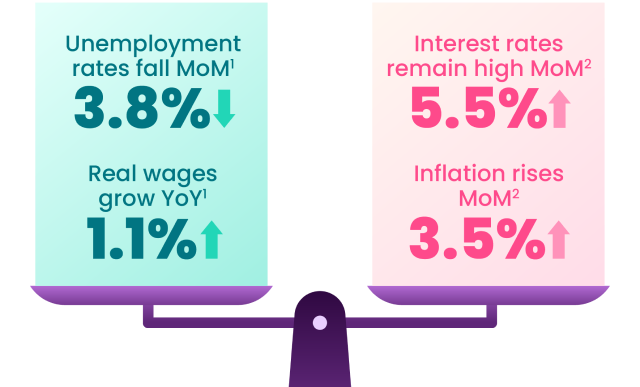

The auto industry is returning to pre-pandemic stability, but the financial realities consumers face today can impact what they’re willing to spend on a vehicle. While customers continue to gain confidence with steady rates, they haven’t been able to reap the benefits just yet. Rising inflation and cost of living pose valid concerns for purchasing power, despite decreased unemployment and increased wages.

DIGGING IN.

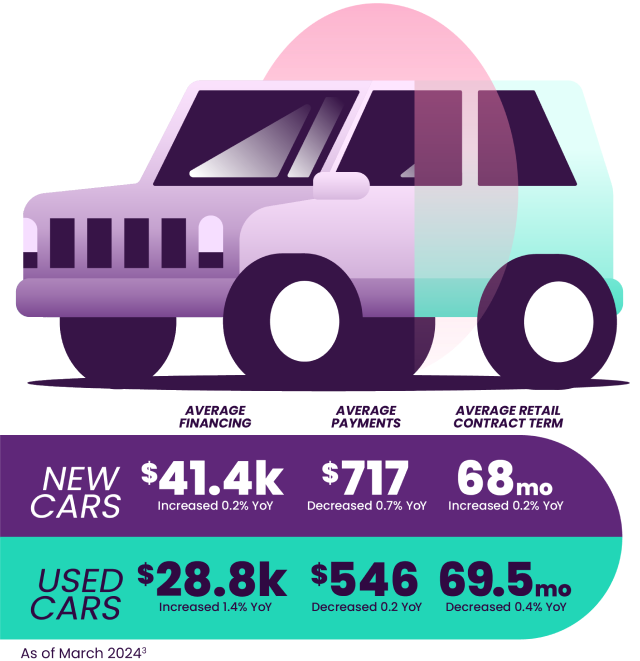

Let’s take a closer look at vehicle financing and payments to understand what customers are up against. The average dollar amount financed remains high for new and used cars paired with larger near-record payments. Talk about a one-two punch. As pressure builds on everyday saving and spending, consumers are relying more heavily on credit to make large purchases.

1. GIVE THEIR WALLETS A REST WHILE PROTECTING YOUR BOTTOM LINE.

Finding the sweet spot between customer affordability and dealership profitability doesn’t have to be a challenge. Our flexible financing solutions are designed for you and consumers in mind.

- Ally offers up to 120% loan to value financing, which can help reduce the need for a large down payment and can increase customer accessibility to financing.

- Flexibility in financing is key for customers. By expanding their options with a larger selection of finance companies through offerings like Clearlane Pass, you can appeal to a wider range of customers across a broad credit spectrum and capitalize on more opportunities to help sell vehicles.

- When you click the “Certified Used” button to finance with Ally, eligible Certified Pre-Owned Vehicles (CPOV) can increase vehicle valuation by $1,000 and open new PVR opportunities for your dealership while helping satisfy customers’ need for assurance. Qualifying for our Certified benefits can be easy with an OEM or non-OEM certification or with a Limited Warranty that meets Ally’s requirements.

- Great vehicle valuation can lead to increased sales opportunities and more competitive deals. Vehicles purchased on SmartAuction and financed with Ally are eligible for SmartAuction Finance Advantage. Retail a vehicle within 120 days from the SmartAuction purchase date and finance with Ally, and the amount financed will be based on the greater of book value or SmartAuction purchase price (including your SmartAuction buy fee) to help you realize more upside. Used vehicles purchased from other auctions receive the same book out advantage for 90 days.

2. ALLEVIATE THEIR CONCERNS FOR THE LONG RUN.

High Loan-to-Value (LTV) ratios across the industry mean customers are borrowing a significant amount of the vehicle’s value instead of paying a large portion upfront. With a suite of protection products tailored to your customers’ needs, you can help give customers have peace of mind as they drive off the lot.

- When the unexpected happens, customers want to know they’re covered, and dealers want to defend against loss. Guaranteed Asset Protection (GAP) helps bridge the gap between how much is owed for the vehicle and how much the car is worth if it’s totaled or stolen, offering additional peace of mind. *Exclusions and limitations apply.

- With extended contract terms, consumers may want to keep their vehicles longer and consider a Vehicle Service Contract (VSC) to help cover vehicle repair costs beyond the manufacturer’s original warranty period.

- Ally Auto Care can help customers budget and plan for the maintenance required to keep their vehicles running smoothly, all while improving your PVR potential. Create even more sales opportunities and generate service lane business with Ally Auto Care Plus, a new offering that provides maintenance for hybrids and EVs.

3. EQUIP THEM WITH THE POWER OF CHOICE.

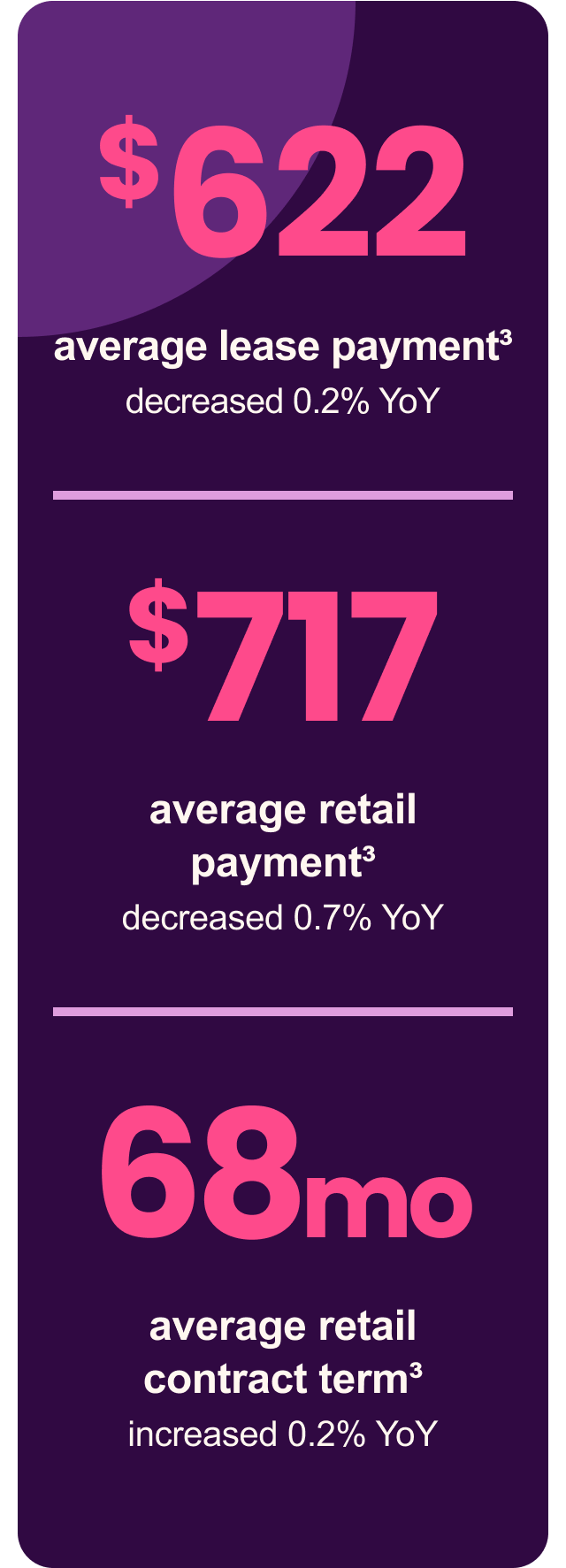

Every customer is different, with unique budgetary needs, including payment preferences, terms and down payments. Providing an option to lease vs buy may help land the deal, as leasing typically offers lower monthly payments compared to financing.

- Leasing may provide customers with a short-term commitment, lower payments and the ability to add on products like SmartLease Protect to fend off against excess wear and tear. The customer is also protected by a manufacturer’s warranty and these typically cover critical components like transmission and engine repair for the duration of the lease. Again, flexibility is the name of the game resulting in more deals and greater satisfaction.

1 Bureau of Labor Statistics (BLS)

2 The Board of Governors of the Federal Reserve System

3 The information supplied by Power Information Network, a business division of J.D. Power (“PIN”) is based on data believed to be reliable but is neither all-inclusive nor guaranteed by PIN. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinions expressed herein reflect the judgement of Ally Financial at this date and are subject to change.

Full service

Solutions and support for every inch of your dealership and beyond.

Ally provides a full suite of products and services delivered by a stacked team that’s here to help every step of the way.