Many times over the last 20 years, interest rates, trade equity and gas prices have been roadblocks when it comes to selling vehicles. Usually, we have one of these issues to deal with. Now, we have all three at the same time.”

– Pacific West Dealer

It’s no secret: the economy and automotive industry are in a constant state of change. As dynamics shift, so does consumer behavior, making it a challenge for dealers to adapt and offset the impact quickly. Ally is here to help you keep your finger on the pulse.

We conducted research in Q3 and talked with a sample of our highly engaged dealer customers from across the country to bring you the most relevant information.

Many times over the last 20 years, interest rates, trade equity and gas prices have been roadblocks when it comes to selling vehicles. Usually, we have one of these issues to deal with. Now, we have all three at the same time.”

– Pacific West Dealer

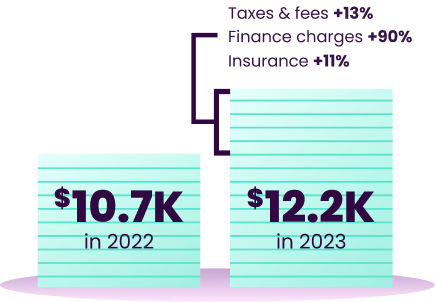

Rising ownership costs may deter consumers from buying vehicles, especially if they’re concerned about additional financial burdens beyond the sticker price.1

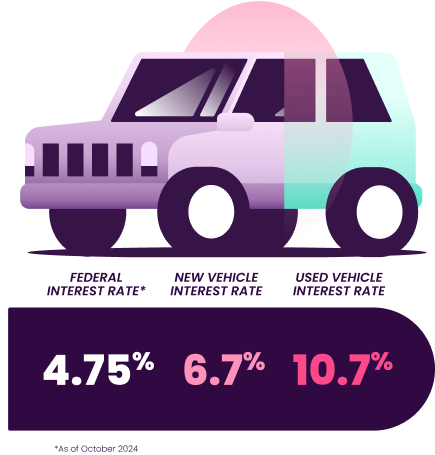

Although the Federal Reserve has reduced rates to around 4.75% this year, consumers aren’t feeling much relief as high average vehicle interest rates continue to squeeze budgets.

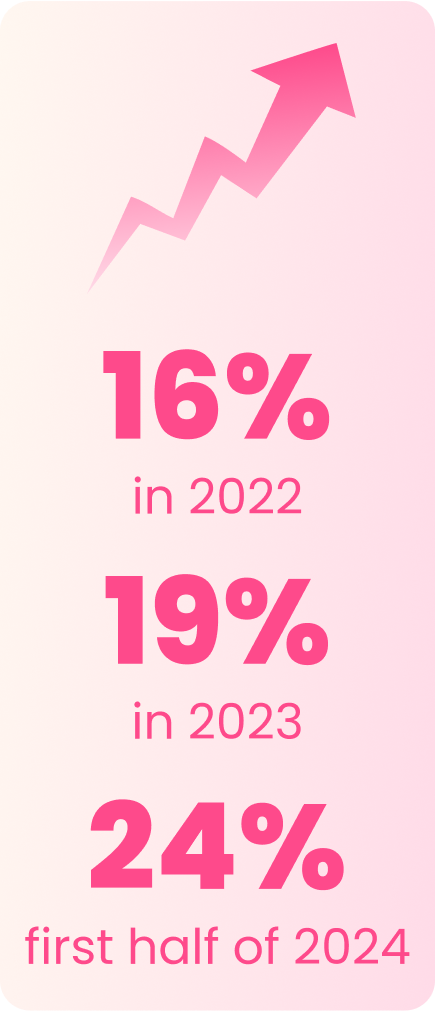

With a three-year upward trend, negative trade equity has quickly become a top challenge, impacting consumers’ decisions on purchases, upgrades and even maintenance.

Bottom Line: Despite the increasing costs of ownership, high interest rates and growing negative equity, most dealers believe there is significant pent-up demand in the market.

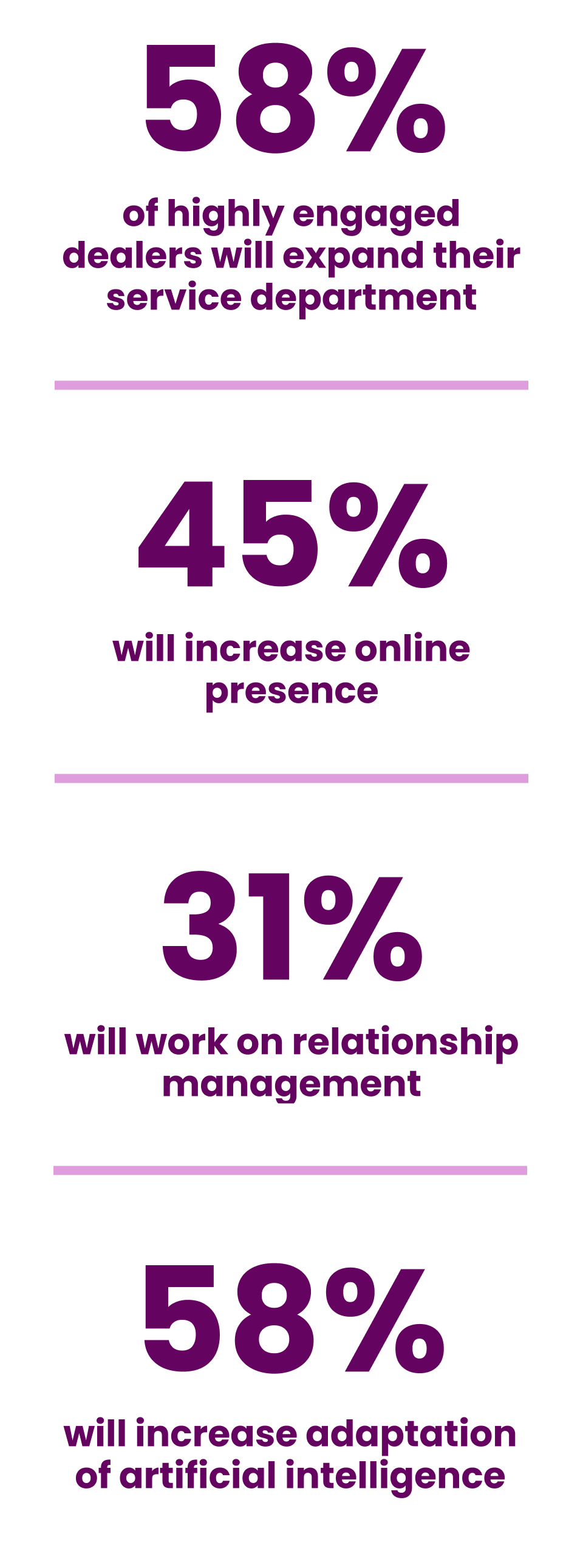

To protect margins and long-term profitability, some dealers are making plans to:

1 Invest internally and expand service offerings over the upcoming year

2 Reduce costs in inventory management

We continue to watch expenses but have found that focusing on aging of inventory is more effective than focusing on operating expenses, many of which have been difficult to lower or eliminate.”

– Northeast Dealer Principle

3 Consolidate their dealerships in a record-breaking market

Bottom Line: Develop your strategy and take actions now. It’s no small task, but you don’t have to go it alone. Ally is here to support you and your customers with the tools, service and expertise to help you keep moving your business forward.

At a time when many customers may be holding off on buying or selling vehicles, they’ll need maintenance. Ally works with dealers to help them drive service lane traffic and keep customers coming back. Learn more about how fixed-ops consulting can help optimize your business.

The single biggest contribution that Ally has made to our business probably comes down to profitability, but the single most impactful contribution that Ally has made to our business is training.”

– Natasha del Barrio, Bert Ogden and Fiesta Auto Group

Our F&I training can help your team identify and close deals based on rapidly evolving customer expectations and hone your employees’ ability to improve product penetration.

Offerings such as Clearlane Pass and benefits for Certified Pre-Owned Vehicles (CPOV) can help you expand options for your customers and take advantage of more sales opportunities.

*Deals cut back by $2500 or more from the requested amount financed.

Ally offers leasing on nearly all makes, providing customers with a short-term commitment, lower payments and the ability to add on protection products, like SmartLease Protect. Explore our full leasing capabilities.

*Floorplan dealers are eligible for a bonus payment of up to $1,000 for each eligible off-lease vehicle purchase.

1 Estimated cost of new vehicles with an annual mileage of 15,000 miles.

2 Kerrigan Blue Sky Report

In this fast-paced industry and evolving economy, it’s vital for dealers to address their customers’ needs while looking out for their own profitability. Ally is always by your side to help navigate those complexities and offer innovative solutions. Contact your Account Executive to learn more about how we can support you.

Full service

Ally provides a full suite of products and services delivered by a stacked team that’s here to help every step of the way.